Trump announces imminent implementation of tariffs on chips

Trump's global tariffs are causing a storm in the stock market, with major tech companies taking a hit, except for semiconductors. Leon's Little Bits of Info tells us that these Asia-made chips power most electronics in the States, so tariffs could significantly increase costs. However, Trump announced that these tariffs on semiconductors will hit soon.

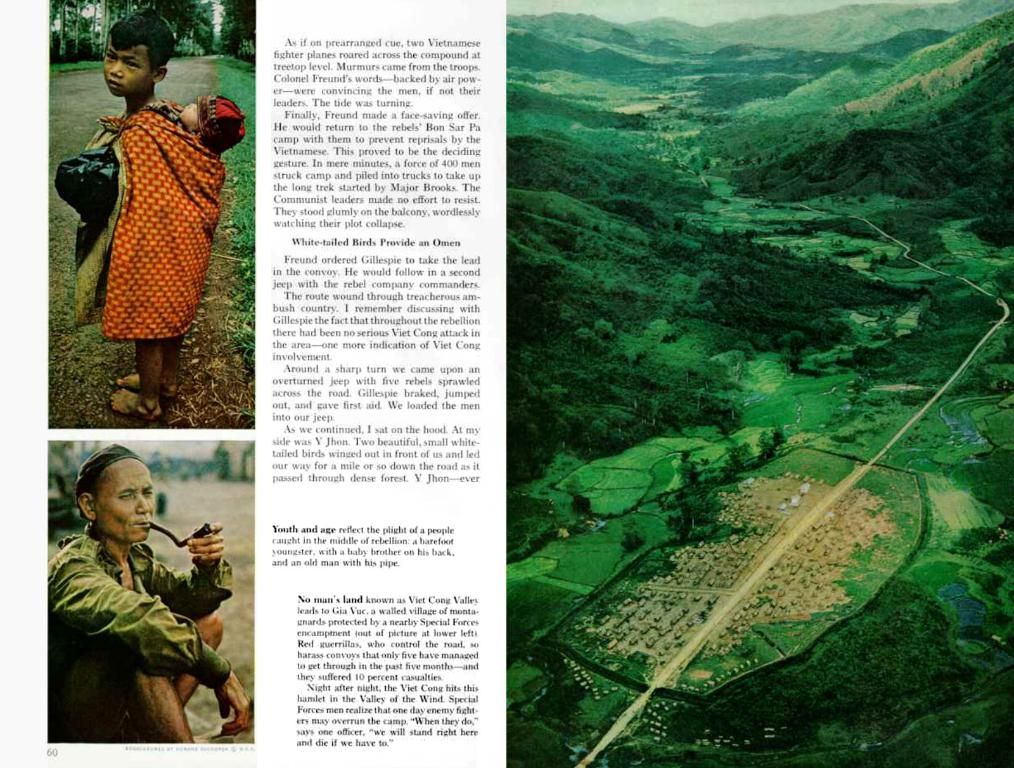

The tariffs have caused headaches for companies like Nintendo, who delayed U.S. pre-orders for the Switch 2 due to tariff concerns. Klarna, that lets you split your UberEats bill into four, even, chewed-up payments, also delayed its IPO.

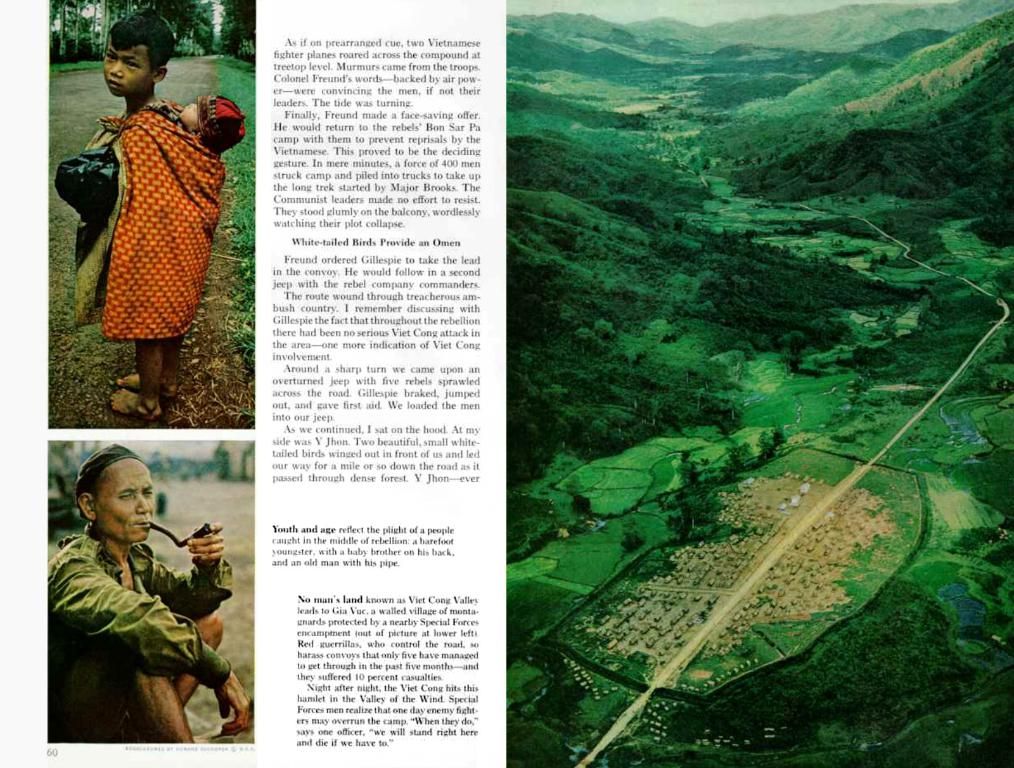

Trump had already voiced his intention to tax semiconductors to boost US manufacturing. The 2022 Shanghai shutdown due to COVID-19 highlighted international supply chain risks. TSMC, a significant chipmaker, plans to invest $100B in US production and R&D facilities, but this takes time. Dan Ives from Wedbush Securities believes it would take Apple three years and $20B to move just 10% of its manufacturing to the US.

While creating domestic competition for foreign-made chips makes sense, remember, American manufacturers rely on foreign hardware, making chips here more expensive. Tom's Hardware points out that an Nvidia GPU selling for $50,000 with a 75% gross margin under a 25% tariff would cost an extra $3,125. For Elon Musk's mega data centers with a million GPUs, this adds up to $3.125B.

Trump claims his tariffs will even the playing field, but moving production to the US takes time. Products here are likely to remain more expensive, as labor and regulations cost more. High-margin industries like chipmaking may be suitable for reshoring, but it's unclear if locally-made physical goods can compete globally.

The US, a service-oriented economy, may focus on automating manufacturing, given the costs and low desire for manual labor. However, under these tariffs, Americans could end up paying more for potentially lower-quality goods, with a regressive impact on low-income citizens. For businesses, higher costs could make them less competitive, which could hurt at a time when China is leading in fields like AI and automotive.

Some experts argue that a US budget deficit means it spends more importing than exporting. Instead of tariffs, negotiating lower drug prices or other solutions could balance the budget without harming its citizens.

Jay Powell, Fed chair, warns that these tariffs could lead to higher inflation and slower growth, and could potentially raise unemployment. But he also says the Fed won't immediately lower interest rates to soften the blow. So, it seems Powell won't bail Trump out, despite criticism from the business community.

- chipmakers, like TSMC, are planning to invest heavily in US production and R&D facilities, but this process is expected to take time.

- Trump's tariffs on semiconductors could significantly increase costs for tech companies, especially those relying on imports, such as Nintendo and Klarna.

- Moving chip manufacturing to the US might be suitable for high-margin industries, but the locally-made physical goods may not be able to compete globally due to higher costs.

- Experts argue that instead of tariffs, the US could negotiate lower prices for goods, such as drugs, to balance the budget without hurting its citizens.