Slower Selling of Large XRP Quantities - Exploring Potential Implications on Value

Rewritten Article:

XRP prices soar 20%: What's causing the crypto whale shift?

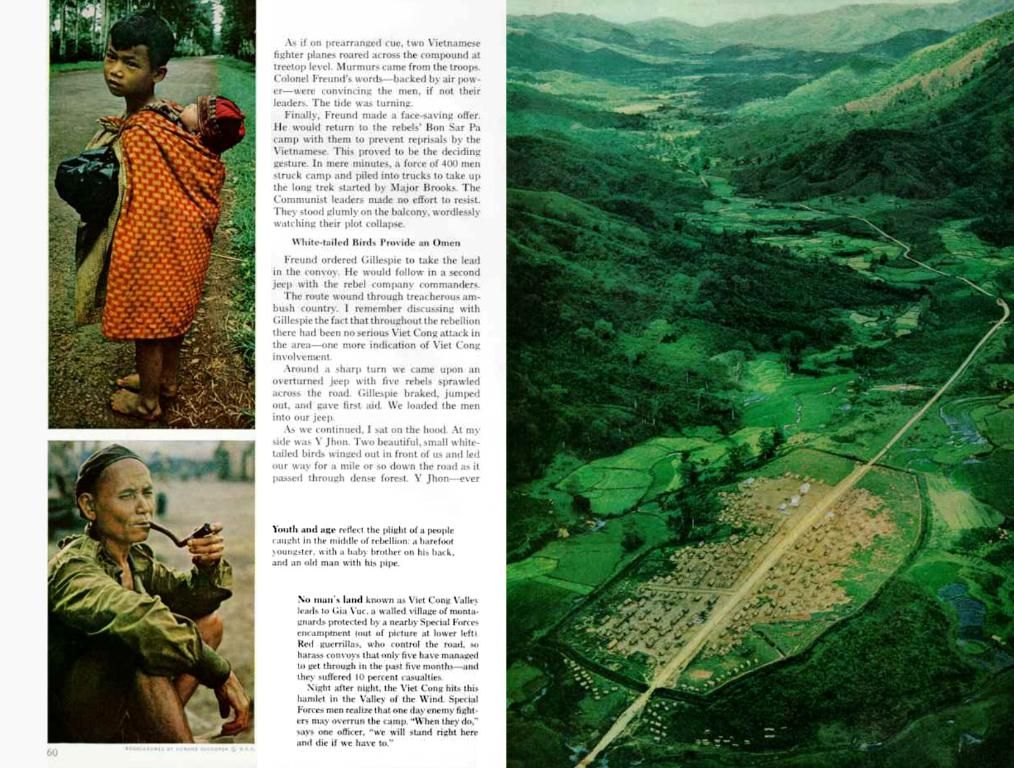

In the recent heat of May, XRP's price skyrocketed around 20%. But what's striking is the mysterious dance of XRP whales – the big fish with stacks of the digital token.

After months of ruthless selling, these whales seem to be playing a new tune. They're slowing down their sell-offs, creating a buzz about a possible XRP resurgence.

XRP Whales Tap the Brakes, Signaling a New Groove in Crypto

CryptoQuant's charts reveal that XRP whales were brutal in early 2025. They aggressively peddled their stocks, pushing net flows deep into negative territory. This behavior suggested that heavy hitters were taking advantage of high liquidity and price momentum to cash out.

But the tide might be turning. Kripto Mevsimi's analysis shows that the big sell-offs have almost stopped. The 30-day moving average Whale Flow chart is painting an uptrend in net flow bars – a significant reduction in selling pressure.

While this ain't a full reversal yet, Mevsimi is optimistic. "Whale flow reversals often foretell sustainable recoveries. This shift could be an early sign of a base-building phase. Coupled with resilient price, this flow flip is worth keeping an eye on," Mevsimi remarked.

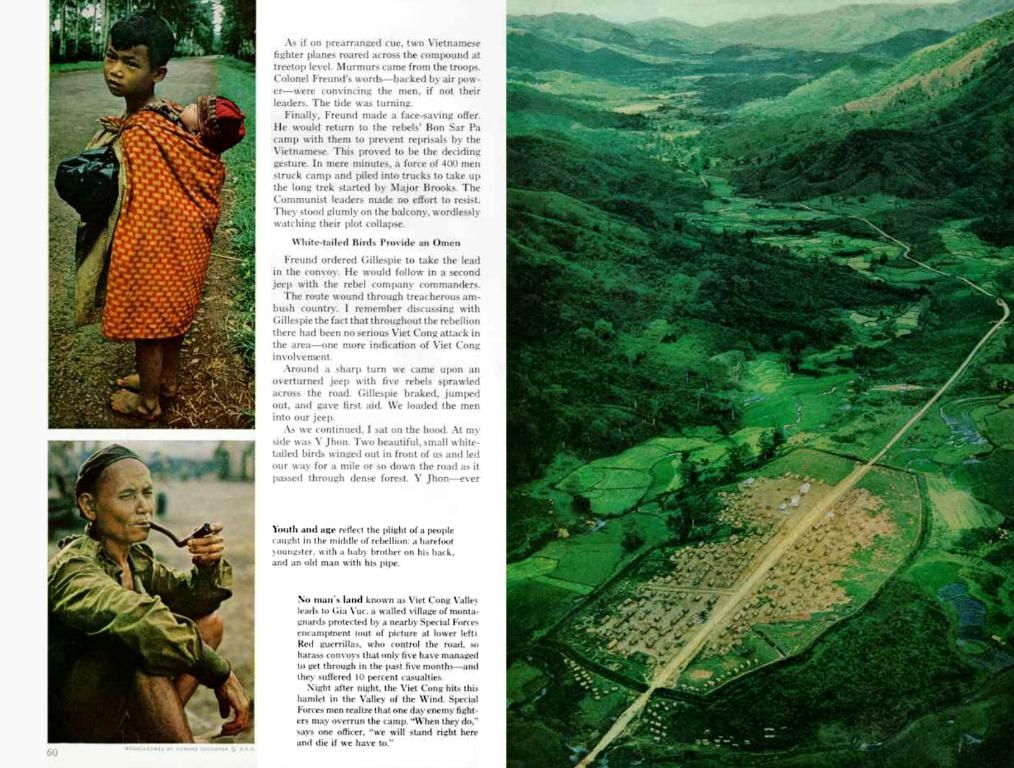

In addition to on-chain metrics, other indicators are caressing a positive note. According to CoinMarketCap, XRP's daily spot trading volume has more than doubled, breaking the $10B mark – a clear sign of investor interest.

Interestingly, the community over at CoinMarketCap seems pretty pumped up. Nearly 88% of investors express positive sentiments towards XRP.

Even more intriguing is that Santiment data reports an 11% increase in XRP-holding wallets in 2025 – proof of a growing interest from the crypto community.

Uphold: Your Gateway to Emerging Assets

Up for some trading? Uphold's got you covered. Exchange between various assets, including crypto, stocks, and precious metals, with ease. Better yet, gain early access to hot new tokens!

Join Uphold Today!

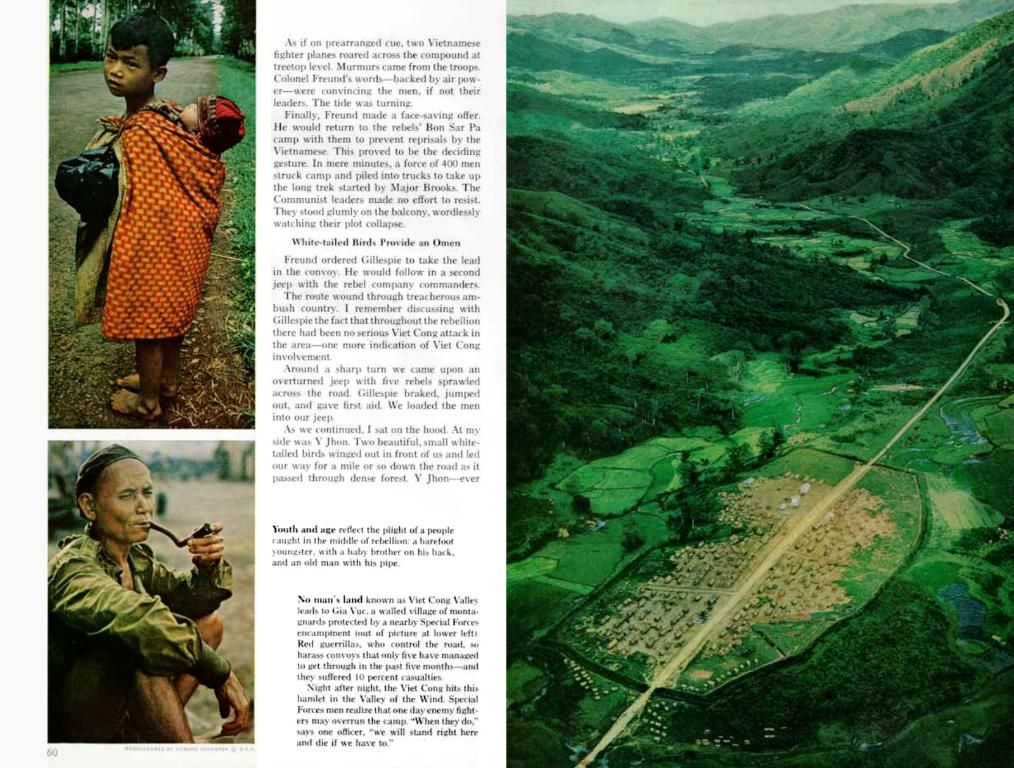

House Bill 594: A New Song for XRP Investors in Missouri

Missouri's House Bill 594, which eliminates capital gains tax on cryptocurrencies like Bitcoin and XRP, could be music to the ears of US crypto investors. Santiment explains that this bill, if passed, would allow investors in the state to cash in their crypto gains tax-free – a sweet deal indeed!

Analysts Tout Liquidity's Role in XRP's Price Swings

If you ask Dom, a crypto analyst, liquidity is the key to unlocking XRP's breakout potential. He says that liquidity, not just market cap, determines XRP's ability to surge.

His research suggests that a mere $61 million in net inflows could catapult XRP's market cap by nearly $17 billion. This underscores how sensitive XRP is to liquidity shifts.

With trading volume escalating and whale selling pressure easing, XRP seems poised to court more capital. However, if Dom's analysis is on target, it's important to remember that XRP's market cap could tumble just as swiftly with only tens of millions in net outflows.

Disclaimer:

BeInCrypto is dedicated to delivering fair, transparent reporting. Our aim is to provide accurate and timely information. However, readers are advised to independently verify facts and consult professionals before making any investment decisions based on this content. Terms and conditions, privacy policy, and disclaimers have been updated.

- Despite months of selling by XRP whales, there appears to be a shift in their strategy, with net sell-offs slowing down, hinting at a potential XRP resurgence.

- On-chain analysis reveals that the aggressive selling by XRP whales earlier in 2025 pushed net flows into negative territory, suggesting heavy selling pressure.

- However, recent data shows a significant reduction in selling pressure, as the 30-day moving average Whale Flow chart indicates an uptrend in net flow bars.

- CryptoQuant's charts also show that XRP's daily spot trading volume has more than doubled, reaching over $10 billion, demonstrating increased investor interest in the digital token.

- In addition to on-chain metrics, sentiment within the XRP community on platforms like CoinMarketCap is positive, with nearly 88% of investors expressing optimistic views towards XRP.

- The growing interest in XRP is also evident in the increase in XRP-holding wallets, as reported by Santiment, with a 10% rise in 2025.

- The potential for XRP's price to move significantly depends on liquidity, according to crypto analyst Dom, who states that a mere $61 million in net inflows could raise XRP's market cap by nearly $17 billion.