skyrocketing user activity drives Solana's token price to surge by double digits, teasing potential for further gains with SOL

Fired Up on Solana: The Scorching April Boost for SOL

The Layer-1 (L1) blockchain network Solana has been ablaze with activity this April, as highlighted by key metrics such as an impressive increase in daily transactions, fees, and revenue. This blazing surge has sent the network's native token, SOL, soaring 16% over the past 30 days. With Solana refusing to cool off, SOL's ascent looks set to continue in the short term.

Solana's Inferno of User Activity Fueling SOL's Price Rise

Solana's slaughterhouse of user activity this month is clearly visible in the network's growing daily transaction count, according to data from Artemis. The network has seared through an impressive 99 million transactions since April's start, marking a 12% monthly increase in daily transactions.

The resultant intense engagement on the network has sent both network fees and the revenue generated from them skyrocketing. Artemis reports that transaction fees on Solana have experienced a 35% surge, while fee revenue has climbed by 26% over the same period.

Fill up your eToro account with $100 and secure a $10 bonus!

- Sign up now

- Deposit $100

- Remember, this investment is high-risk, and you shouldn't expect any protection if something goes wrong.

Feast on the Facts This heatwave of user activity across Solana has ignited demand for its native token, SOL. As more users stoke the network, the need for SOL to facilitate transactions and pay fees escalates. This spark has catapulted SOL skyward by over 16% during the past month, a testament to growing investor faith in the network and the positive correlation between user activity and token value.

SOL: The Volcano That Could Keep Erupting

SOL's daily chart showcases the mounting pressure building among its market participants. At press time, readings from SOL's Directional Movement Index (DMI) attest to the buying pressure. SOL's positive directional index (+DI, blue line) remains above its negative directional index (-DI, orange line).

The DMI indicator assesses the strength of an asset's price trend. It consists of two lines: the +DI, marking upward price movement, and the -DI, symbolizing downward price movement. When the +DI exceeds the -DI, as in SOL's case, the market is bullish, with upward price movement dominating the sentiment. If this trend persists, SOL could burst through the $171.88 barrier.

However, if Solana's inferno of user activity subsides, impacting SOL's demand, the token could shed recent gains, crack under the support at $142.59, and plummet to $120.81.

eToro | YouHodler | Wirex | NEXO | MEXC

Feast on the Facts | eToro | YouHodler | Wirex | NEXO | MEXC

eToro | YouHodler | Wirex | NEXO | MEXC

Disclaimer

This price analysis article serves informational purposes only and shouldn't be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions can change abruptly without warning. Always perform your due diligence and consult a professional before making any financial decisions. Also, please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

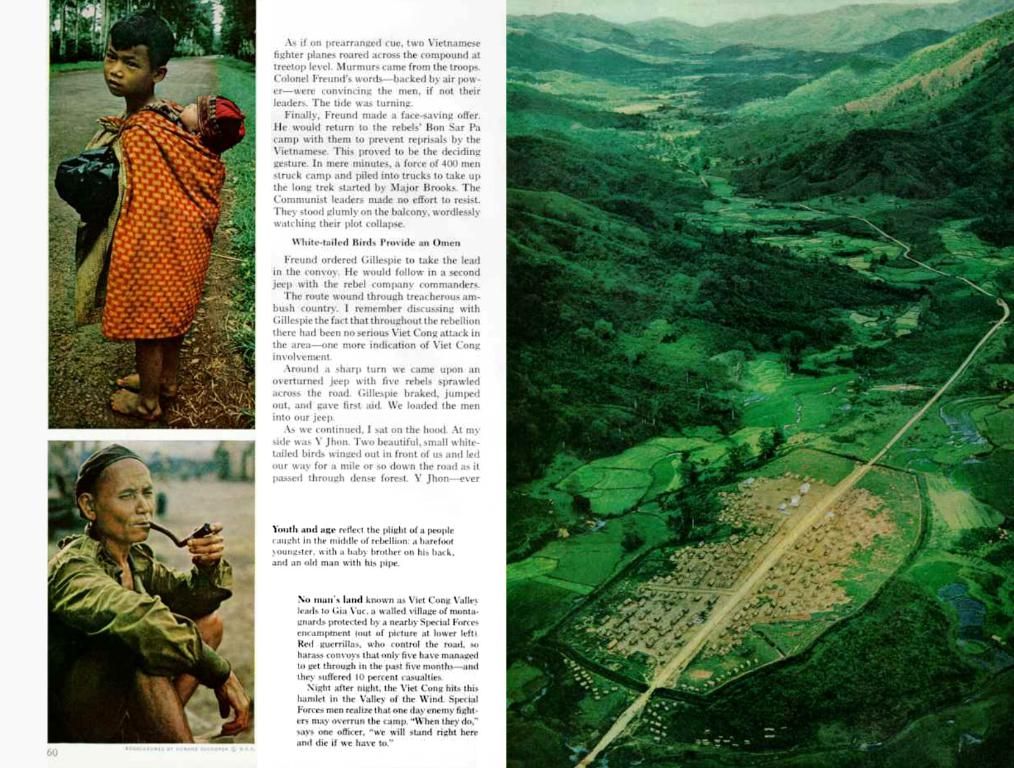

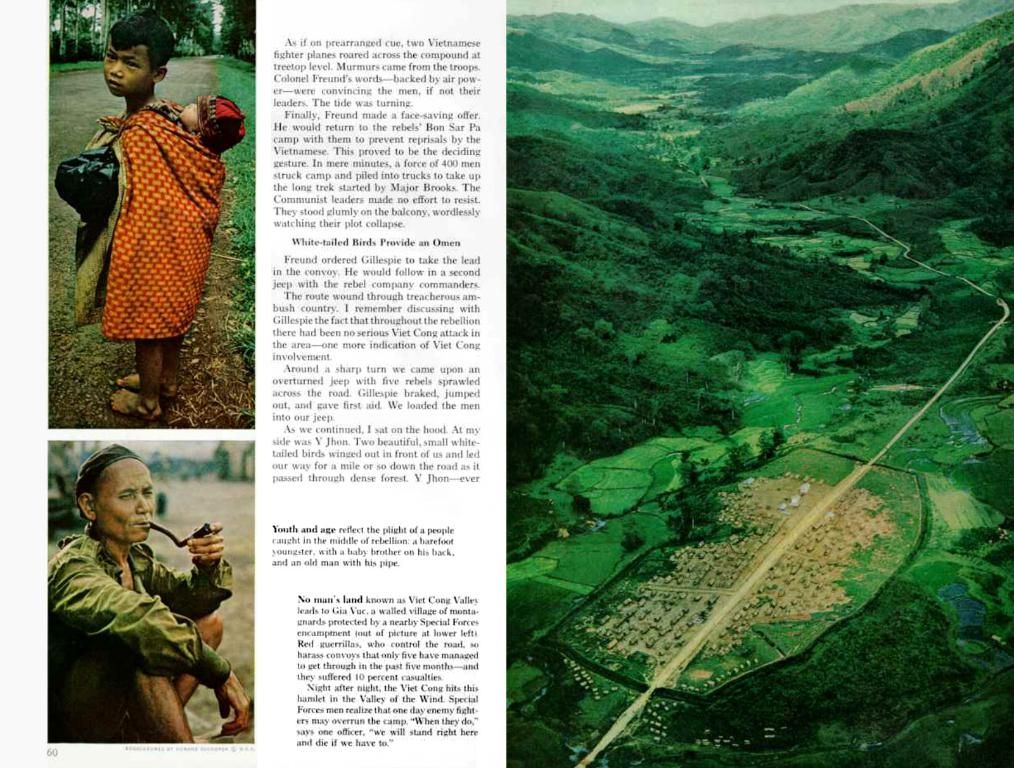

Extra Helping:The fiery increase in Solana's user activity this April, propelling SOL's price upwards, can be attributed to several factors:

- Understanding the Surge in User Activity:

- Increased Transactions and Fees: Solana has witnessed a notable increase in daily transactions, driving a 35% surge in transaction fees and a 26% hike in fee revenue[1]. This surge in activity suggests growing user participation and engagement.

- Key Drivers of the Increased Activity:

- Adoption and Infrastructure Improvements: Solana's solid infrastructure capabilities, including swift transaction speeds and the ability to accommodate a wide range of decentralized applications (dApps), likely propelled its use. The "Crossroads 2025" conference in Istanbul, showcasing new dApps and scaling infrastructure, could have also spurred user interest[2].

- Competitive Positioning and Market Perception:

- Solana leads the pack in terms of daily user activity compared to other blockchain networks, with over 4.3 million daily addresses[4]. This dominance underscores Solana's strong market positioning, which may influence investor confidence and, in turn, drive the price increase.

- Market Trends and Expectations:

- The blend of technical patterns, such as the "cup and handle" formation, and strong network fundamentals have led analysts to predict potential price breakouts beyond $180[2]. Moreover, Solana's aims to reach a $250 billion market cap by 2025 highlight its growth potential and the hopeful anticipation surrounding it[5].

Overall, Solana's surge in user activity reflects a symphony of improved network performance, strategic marketing efforts, and positive market sentiment, ultimately leading to the increased demand and price rise of SOL.

- The surge in SOL's price over the past month can be attributed to an increase in user activity on the Solana L1 blockchain network, as evidenced by the network's growing daily transaction count, a 35% increase in transaction fees, and a 26% rise in fee revenue.

- Artemis reports that Solana has seen over 99 million transactions since April's start, marking a 12% monthly increase in daily transactions, indicating growing user participation and engagement.

- The intense engagement on the network has led to both network fees and revenue generated from them skyrocketing, fueling demand for the network's native token, SOL.

- The positive correlation between user activity and token value has resulted in SOL skyrocketing by more than 16% during the past month, demonstrating growing investor faith in the network.

- The Directional Movement Index (DMI) indicates that there is significant buying pressure on SOL, with its positive directional index (+DI) remaining above its negative directional index (-DI), suggesting an overall bullish sentiment.

- If Solana's user activity subsides, potentially impacting SOL's demand, the token could shed recent gains and plummet to $120.81, underscoring the importance of maintaining strong user engagement and network performance.