Santander Chile introduces eco-friendly credit cards line

In a significant move towards a greener and more secure future, Santander Chile has launched a new range of Eco Santander cards made from recycled materials. The innovative cards are part of a global trend towards sustainable and secure cards in the payment industry [1].

The development of these eco-friendly cards was a collaborative effort involving multiple people and teams at Santander Chile. Nicolás Besa, manager of Payment Systems at Santander Chile, emphasized the importance of information security in the new Eco Santander Cards. To enhance security, the cards incorporate advanced fraud prevention measures such as real-time transaction monitoring, the ability to freeze or unfreeze cards instantly via mobile apps, and controls to block certain transaction types like gambling, online, international, and contactless payments [1].

Users also benefit from personalized alerts via SMS or email to stay informed about suspicious or near-limit activity, boosting their control and safety [1]. Regarding social inclusion, the Eco Santander cards and Santander’s mobile banking app offer accessibility-focused innovations like voice-assisted features, interactive tutorials, a customizable interface, and AI-enhanced customer support, making banking services more approachable for all customers [2].

The Eco Santander cards display less information on the front and back to enhance security in both face-to-face and digital transactions. This design also provides greater protection against possible fraud attempts [2]. The security code for online purchases on the Eco Santander Cards is generated via an app, such as Uber or Netflix, ensuring a dynamic and secure process [1].

Santander Chile has become the first bank in Chile to unveil a more environmentally friendly range of cards. The vertical format and attractive designs of the Eco Santander cards further enhance their appeal [2]. The bank's goal is to shun the use of plastic while responding to the demands of a digitized world [3].

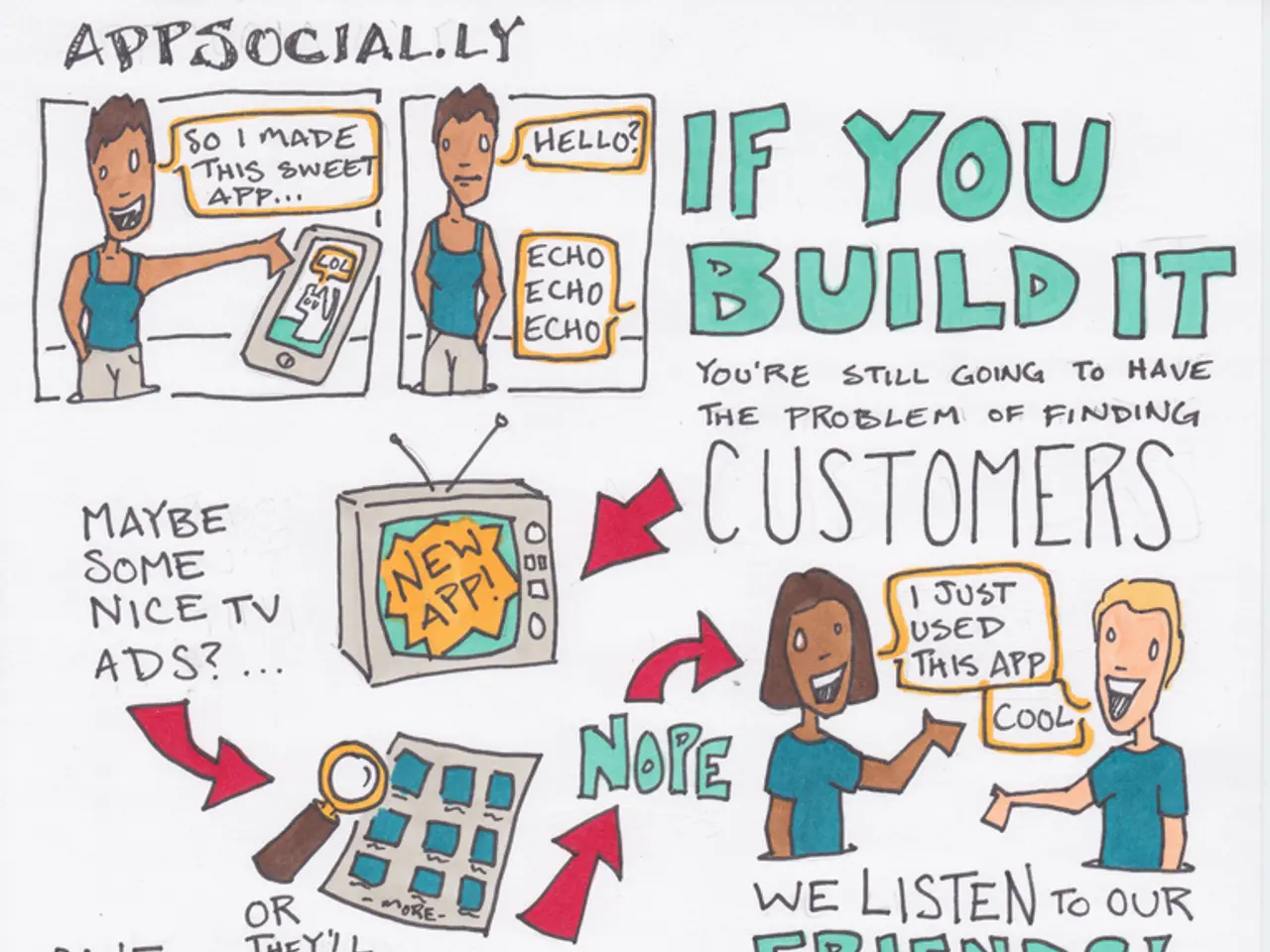

Interestingly, 73% of people consider information security as extremely important, and 60% of transactions in Chile are now made in online stores [4]. The launch of the Eco Santander Cards is, therefore, not only a step towards sustainability but also a response to the growing number of online transactions [5].

Spain, Portugal, Poland, and Brazil have also launched sustainable cards in their respective markets last year, signalling a global shift towards environmentally friendly and secure payment solutions [1]. With these innovative features and commitments, Santander’s Eco Cards are set to redefine the financial landscape, offering a safer and more inclusive financial experience.

[1] Santander Chile Press Release, "Santander Chile launches its Eco Santander Cards," 2021. [2] Santander Chile, "Accessibility in Banking," 2021. [3] Nicolás Besa, interview with El Mercurio, "Santander Chile's Commitment to Sustainability," 2021. [4] GlobalWebIndex, "Digital 2021: Chile," 2021. [5] Nicolás Besa, interview with Diario Financiero, "The Future of Online Payments in Chile," 2021.

1.Recognizing the significance of both security and sustainability in today's digital business environment, Nicolás Besa, Santander Chile's manager of Payment Systems, implemented advanced technology in the new Eco Santander Cards to ensure information security.

- In a bid to cater to the changing demands of a digitized world and the growing number of online transactions, Santander Chile's Eco Santander Cards not only prioritize sustainability but also aim to redefine the financial landscape by offering a safer and more inclusive financial experience through technology-driven features.