Con Artist Steals Corvette; Capital One Retaliates

In the ever-evolving landscape of the automotive industry, fraud poses a significant challenge. Synthetic identities, credit washing, and income misrepresentation account for nearly 70% of total auto-fraud risk, making it a pressing concern for dealerships and lenders alike. To combat this issue, Capital One has introduced ProtectID, a cutting-edge fraud-prevention tool that integrates real-time AI-driven analysis within its Dealer Navigator platform.

Sanjiv Yajnik, Capital One's president - financial services, unveiled ProtectID, designed to detect suspicious patterns in auto loan applications and alert dealerships to potential fraud indicators. When a dealer submits a loan application, ProtectID performs a "soft pull" on the applicant’s credit and evaluates additional factors through AI that connects data across multiple forms of consumer credit.

The system's digital verification process is swift, self-serviceable, and comprehensive. It includes phone-number validation, government ID upload, and a selfie comparison to government ID photos in databases. If an application is flagged, the applicant receives a secure verification link to confirm identity.

ProtectID enhances the judgment of dealership teams and instills confidence when selling cars, according to Fortunes O'Neal, general manager of GM Central Kia of Plano (TX). The multiple levels of verification enabled by ProtectID make it easier for dealerships to avoid fraud, as each manager in the 32 Grapevine stores notifies the others about fraud attempts because a fraudster "usually is not going to stop at one dealership."

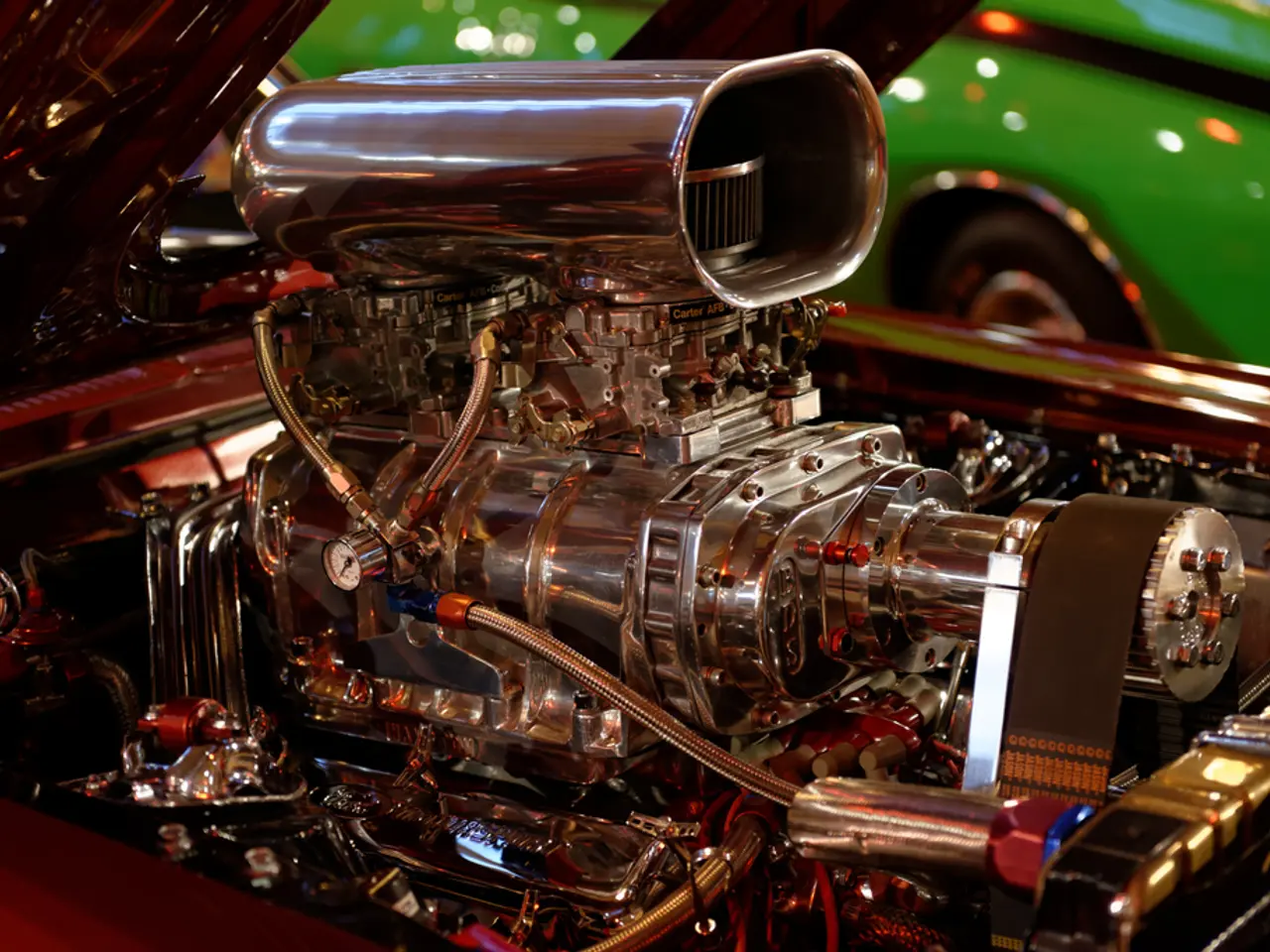

Recently, ProtectID quashed a deal at Grapevine Dodge due to suspected identity theft. The well-dressed man who walked into the dealership, showing interest in buying a pricy Chevrolet Corvette, had good credit but wanted a very low down payment. However, ProtectID's real-time analysis flagged the application as suspicious, and the deal was stopped. The person whose identity was stolen was grateful and reported it to the authorities.

By analysing credit patterns, connections, and abnormal application behaviour, ProtectID identifies these risks early in the loan process, enabling dealerships to intervene before completion. The system's combination of automated detection with dealer discretion minimises false positives and maintains accuracy, continuously tuning the AI model to improve fraud detection over time.

As a finance giant with more than 100 million bank accounts and credit card customers, Capital One is well-positioned to combat fraud in the auto industry. With ProtectID, dealerships can rest assured that their businesses are protected, fostering a safer and more secure environment for all parties involved in the car-buying process.

Sanjiv Yajnik, Capital One's president - financial services, introduced ProtectID, a fraud-prevention tool designed to identify suspicious patterns in auto loan applications and alert dealerships to potential fraud indicators. In the auto retail business, ProtectID uses AI-driven analysis within Capital One's Dealer Navigator platform to connect data across multiple forms of consumer credit, technology that streamlines the digital verification process with swift and comprehensive methods like phone-number validation, government ID upload, and selfie comparison to government ID photos in databases.