Quick Summary

- Strategy invests a whopping $285.8 million in 3,459 BTC, increasing their Bitcoin stash to a whopping 531,644 coins - worth a staggering $45 billion

- The company used the cash generated from selling their class A common stock to pay for the Bitcoin buy

- Despite uncertainty about trade war consequences, Bitcoin is currently trading at around $85,000

- Other companies like Metaplanet from Japan are jumping on the Bitcoin train, and public company Bitcoin holdings rose 16.11% quarter-over-quarter

- Analysts predict Bitcoin to reach prices between $132,000 and $250,000 by end of the next few years

Strategy's Crypto Spree Continues

Company Buys 3,459 Bitcoins for $285.8 Million, Amassing a Total of 531,644 Bitcoins

Strap yourself in, folks! Strategy (formerly known as MicroStrategy), the Virginia-based financial analytics company, is back in the crypto game, purchasing an additional 3,459 BTC for $285.8 million. This latest acquisition brings their total Bitcoin holdings to an eye-popping 531,644 coins, valued at approximately $45 billion at current prices.

The company is no stranger to the crypto phenomenon, having first dipped its toes into the water in 2020. With this latest purchase, Strategy has acquired an average price of $82,618 per Bitcoin, money earned by selling their class A common stock.

The Bitcoin Rollercoaster Rides On

Despite ongoing concerns about how the Trump trade war (particularly with China) might impact markets, Bitcoin is holding up decently, trading at around $85,024. Analysts remain bullish on Bitcoin's future, with Jamie Coutts predicting the cryptocurrency could skyrocket beyond $132,000 by the end of 2025. On the other hand, Cardano founder Charles Hoskinson suggests Bitcoin could reach an astonishing $250,000 before 2026.

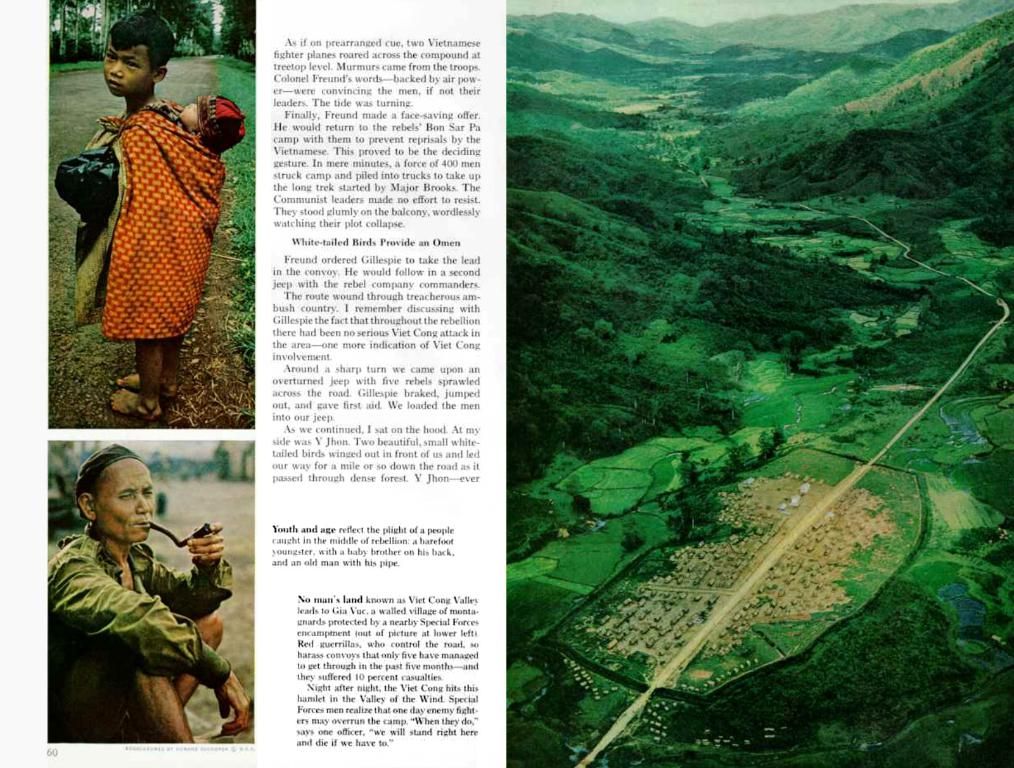

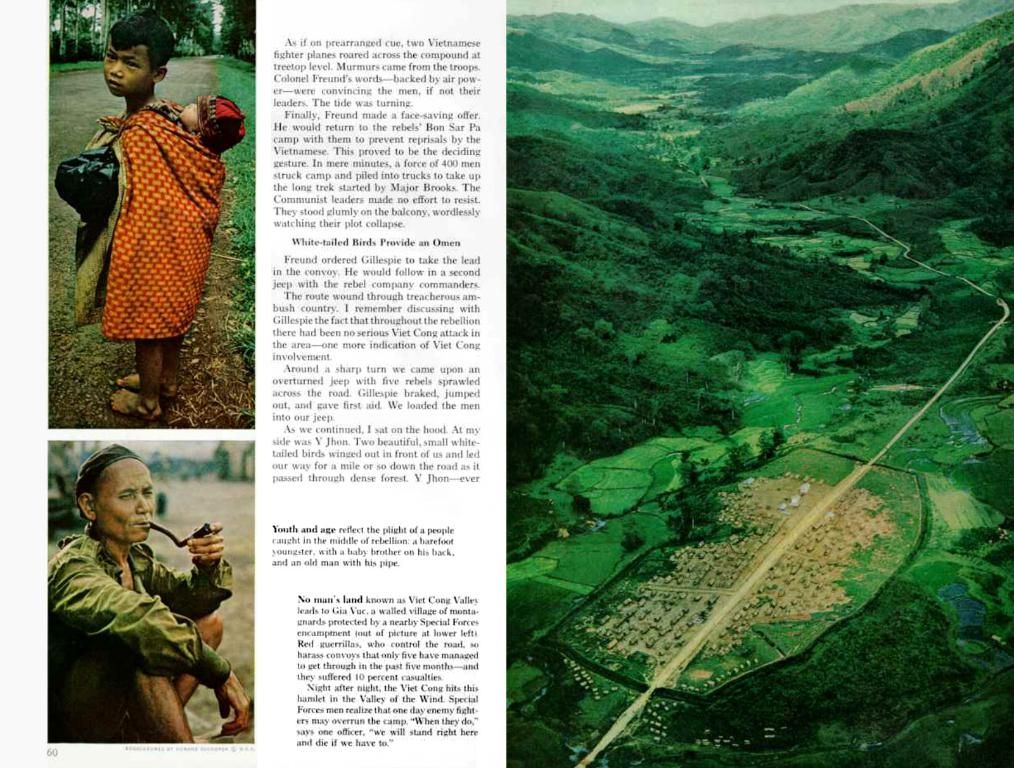

The Japanese Join the Fun

If Strategy's moves are anything to go by, it seems other companies are getting in on the Bitcoin action. Japanese investment firm Metaplanet, often referred to as "Asia's MicroStrategy," has also begun amassing Bitcoin, purchasing 319 coins on Monday for $26.3 million. Metaplanet has set its sights high, aiming to increase its Bitcoin holdings by a whopping 470% to a total of 10,000 coins by the end of the year.

What's Next for Bitcoin?

With corporations like Strategy and Metaplanet investing heavily in Bitcoin, the cryptocurrency's future seems bright. Despite recent market turbulence, it looks like the Bitcoin train is far from slowing down!

Just remember, play smart, folks. This is the wild west of the financial world!

Learn more about the incredible journey of corporate Bitcoin adoption from its inception to the present day.

- Strategy, a Virginia-based financial analytics company, has increased its Bitcoin holdings significantly by purchasing 3,459 BTC for $285.8 million, bringing their total to 531,644 coins worth around $45 billion.

- To fund this acquisition, Strategy sold their class A common stock, using the generated cash to buy Bitcoin at an average price of $82,618 per coin.

- Despite ongoing trade war uncertainties, Bitcoin is currently trading around $85,024, with analysts like Jamie Coutts predicting it could reach prices between $132,000 and $250,000 by the end of 2025.

- Other companies, such as Japan's Metaplanet, are joining the Bitcoin trend, with Metaplanet purchasing 319 Bitcoin on Monday for $26.3 million and aiming to hold a total of 10,000 coins by the end of the year.